OVERVIEW

Moneylion Malaysia aims to revolutionize retail finance with big-data predictive analytics and cutting-edge software development practices. We ingest and apply large arrays of non-traditional data sources to measure and improve financial processes for both sides: the financial institutions and the client user-experience.

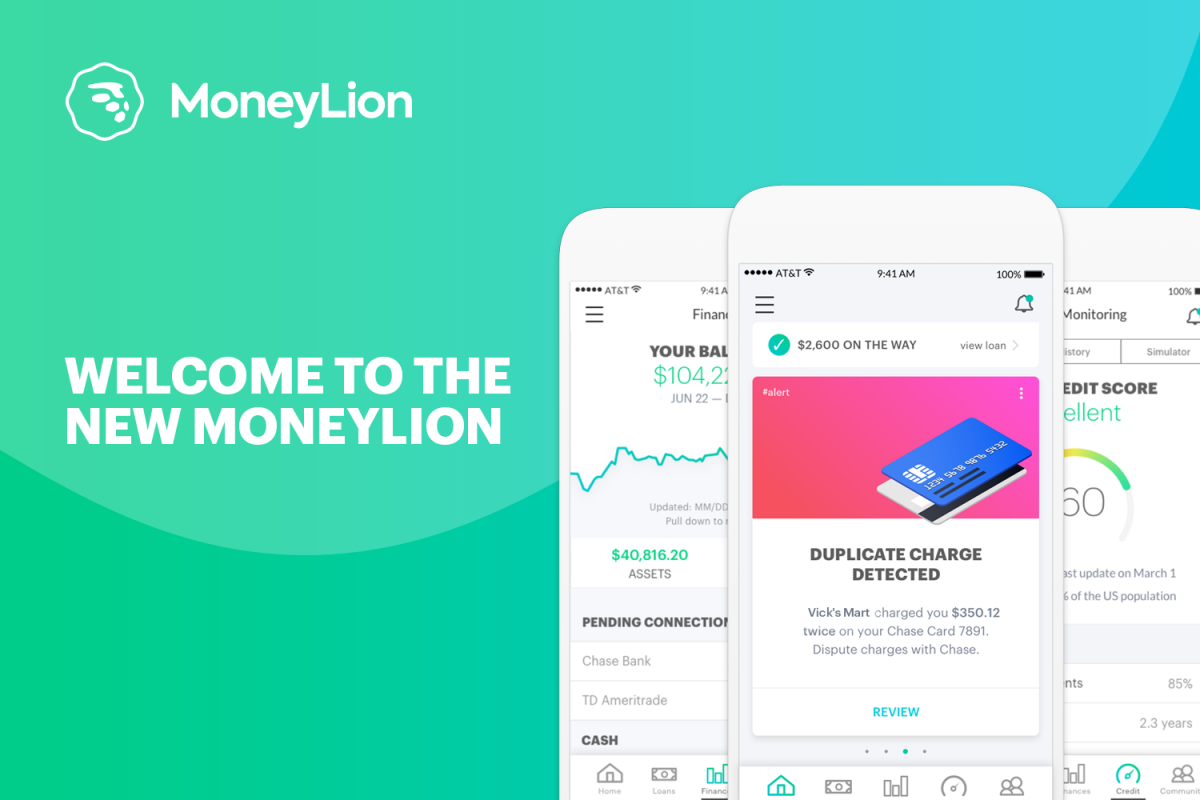

We're passionate about the area of finance that marries data, technology and product design. Our products enable a better financial future for our customers and looks to bring new modes of social engagement never before seen in financial services. For example, MoneyLion provides a closed loop trust building system where users can improve rates on loans through constant engagement with the platform -- specifically, a customer can reduce finance fee payments immediately by building a powerful financial network.

Using modern analytics with all the latest big-data computational tools, MoneyLion builds smarter customer acquisition funnels, more thorough credit models, and better servicing processes for customer retention.

Data doesn't just enable us to deliver smarter loans to a broader universe, it also empowers our customers to make better financial decisions and realistically measure and improve financial health.

MISSION

MoneyLion was founded in 2013 to make money more approachable and to empower consumers to take greater control of their financial lives.

We believe that by building better, smarter products we can help people to build positive, sustainable financial habits.

Since our launch in 2013, we have $5+ million in savings for our customers through rate reduction, 28% reduction in defaults for borrowers who use our tools, and 83% improve in credit with our credit programme.